Insurance

Protecting What Matters Most

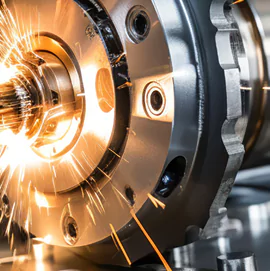

At Astrolite, we understand that insurance is not just about protecting assets; it's about safeguarding your future, your health, and your peace of mind. Our comprehensive insurance services are designed to meet the diverse needs of individuals, businesses, and families, ensuring that you have the right coverage for every stage of life. Whether you're looking for personal insurance or solutions for your business, we offer a wide range of options to provide you with financial security in times of need.

Benefits

Protecting What Matters Most, Today and Tomorrow

Financial Security

Insurance ensures that you or your family won’t face a financial crisis in case of unexpected events. Whether it’s life, health, auto, or home insurance, these policies help cover the financial burden that can arise from accidents, medical expenses, or property damage.

Peace of Mind

Knowing that you’re covered provides a sense of calm and confidence. With insurance, you are prepared for life’s uncertainties, allowing you to focus on your goals without worrying about potential setbacks.

Protection Against Unforeseen Events

Life is unpredictable. Insurance acts as a safety net, protecting you from unforeseen events like accidents, illness, theft, and natural disasters. With the right policy, you’re better equipped to manage these situations effectively.

Risk Mitigation

Insurance helps reduce the financial risks associated with unpredictable circumstances. It spreads the cost of damage or loss over time, ensuring that you are not burdened with large, unexpected expenses.

Access to Better Health Care

Health insurance provides access to a wide network of doctors, hospitals, and treatments, ensuring that you get the best possible care when you need it. It can also help cover medical expenses, which can otherwise be a financial strain.

Retirement Savings and Tax Benefits

Some insurance policies, like life insurance and annuities, can double as investment vehicles for your retirement savings. They also offer tax advantages, helping you build wealth while protecting your loved ones.

A small business owner in the retail industry purchases business insurance to protect against potential risks. When an unfortunate fire damages part of the store, the business insurance policy helps cover the repair costs and lost inventory, allowing the owner to reopen quickly and avoid financial losses. Benefits: • Risk Mitigation: Protects against property damage, liability claims, and business interruptions. • Employee Protection: Includes worker’s compensation and liability coverage. • Asset Protection: Safeguards equipment, inventory, and other business assets from risks.

A medium-sized e-commerce company invests in cyber insurance to protect against data breaches and cyberattacks. When hackers attempt to steal sensitive customer information, the company’s cyber insurance policy helps cover the cost of data recovery, legal fees, and any compensation required for affected customers. Benefits: • Data Protection: Covers the costs of data breaches, identity theft, and cyberattacks. • Business Continuity: Helps minimize downtime and recover from digital threats. • Reputation Management: Supports efforts to manage PR fallout after a cyber incident.

Discover tailored insurance solutions designed to protect what matters most—your life, health, home, and assets. Let us guide you toward peace of mind and financial security.

Secure Your Future, Today

Explore More